The core of Government business is trust, transparency and ethics. In everything it does, it must take into account these three factors. AI adoption in various agencies must also have these values embedded into its system.

AI for Paperless Court System to unify court data in the US Federal Government and accelerate virtual hearings.

Using AI remove language and accessibility barrier by translating and transcribing judicial proceedings in real-time to enable a truly democratic process.

The outcome is a digital court system with improved efficiency, quality and trust of justice through streamlined, integrated and transparent operations.

Service citizen requests in real-time, anytime on any devise and through any digital channel with AI. Using spoken natural language as the primary user interface to validate citisens and respond to their requests immediately. This will provide satisfying service that is fast, helpful and available to them any time.

Tax Fraud Prevention to enable insights to identify and prevent tax fraud.

Inspect millions of transactions in real time to identify and prevent tax fraud. Perform predictive risk modeling and scoring to identify known tax fraud patterns and anomaly detection for unknown patterns. This will result to an accelerated responsiveness with critical and timely insights to protect your citizens.

Deliver Connected Government Services with high-quality, live-speech-to-text translations in 24 languages.

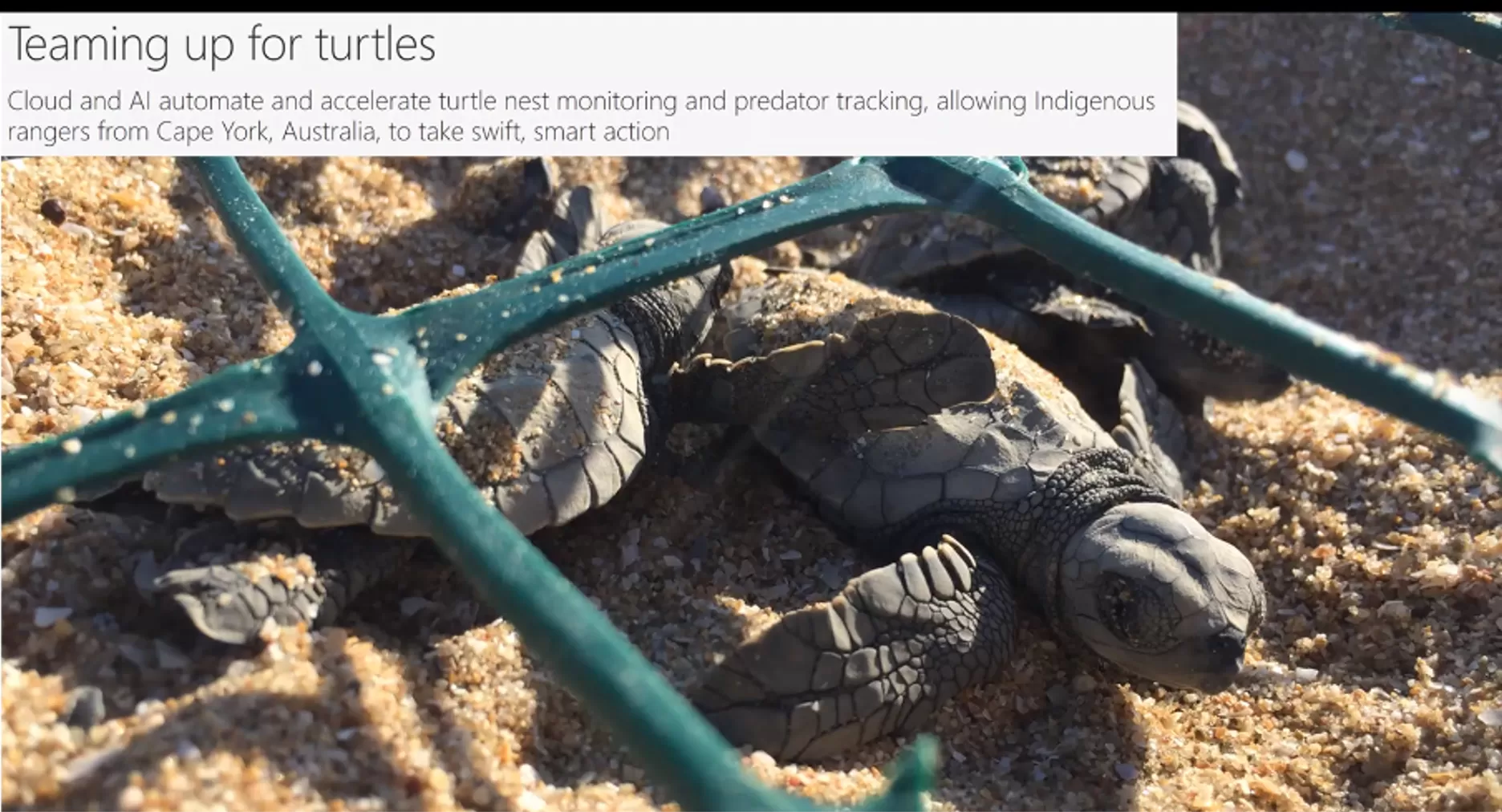

AI-based crisis management assist first responders in saving time by providing timely insights from location-specific data that includes next-best recommended action. Digitise, personalise and accelerate response management by proactively directing first responders to crisis scenes.

The outcome is a friction less first response through enhanced situational awareness for maximum impact.

Tax Fraud Prevention to enable insights to identify and prevent tax fraud.

Inspect millions of transactions in real time to identify and prevent tax fraud. Perform predictive risk modeling and scoring to identify known tax fraud patterns and anomaly detection for unknown patterns. This will result to an accelerated responsiveness with critical and timely insights to protect your citizens.

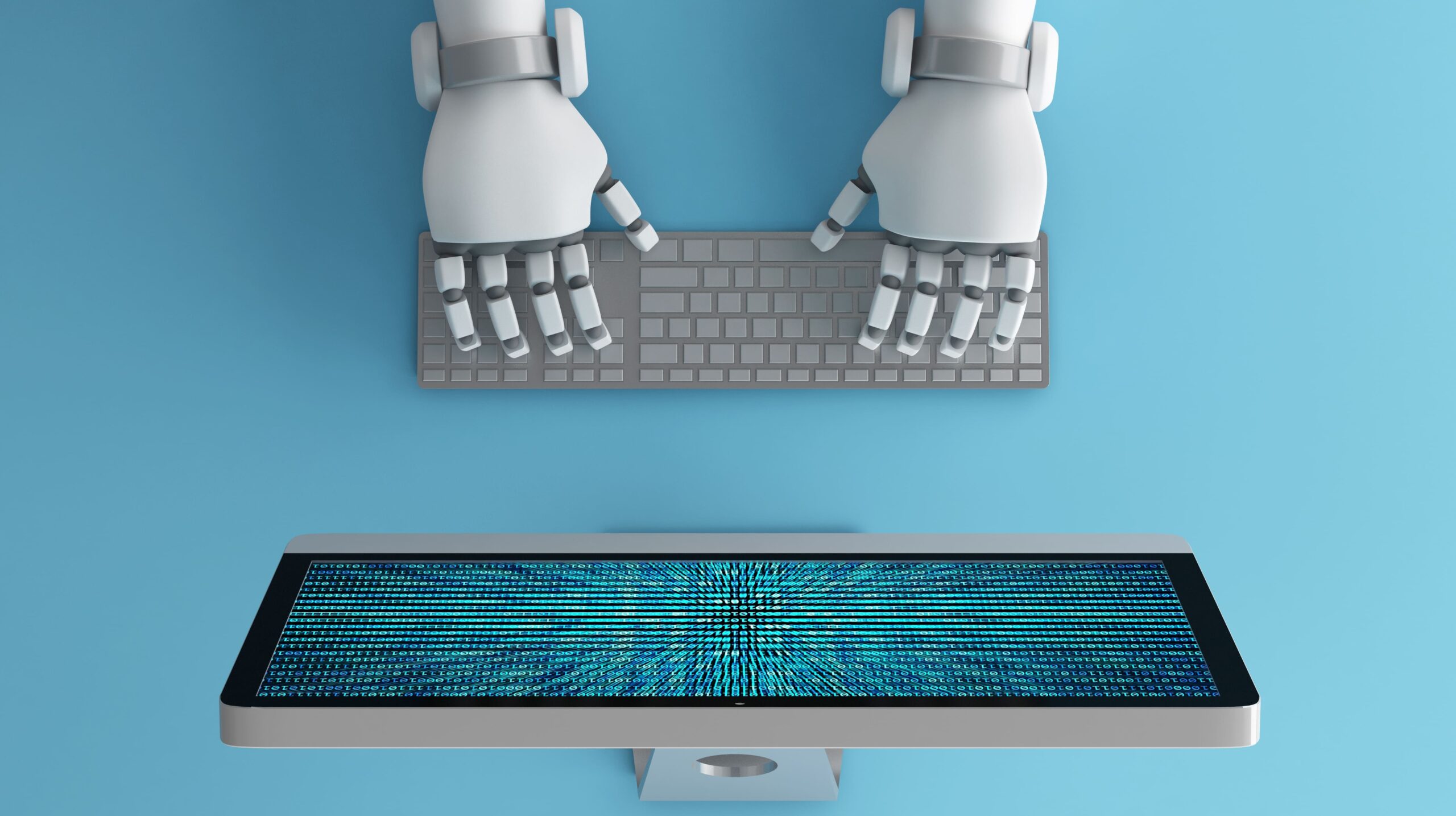

The explosion of data requires the government agencies to do more with less. Manual work is not just possible and practical anymore. Most common uses include expense automation, text summation, intelligent triage using Natural Language Processing (NLP) and texgt analytics, and cognitive search.

Government has not been setup to democratise use of data. Their original structure has not been setup for networking. Often they work in silos. Modern data platforms are changing this. Thus, data governance and security will be highly influential important for these agencies when considering new technology.

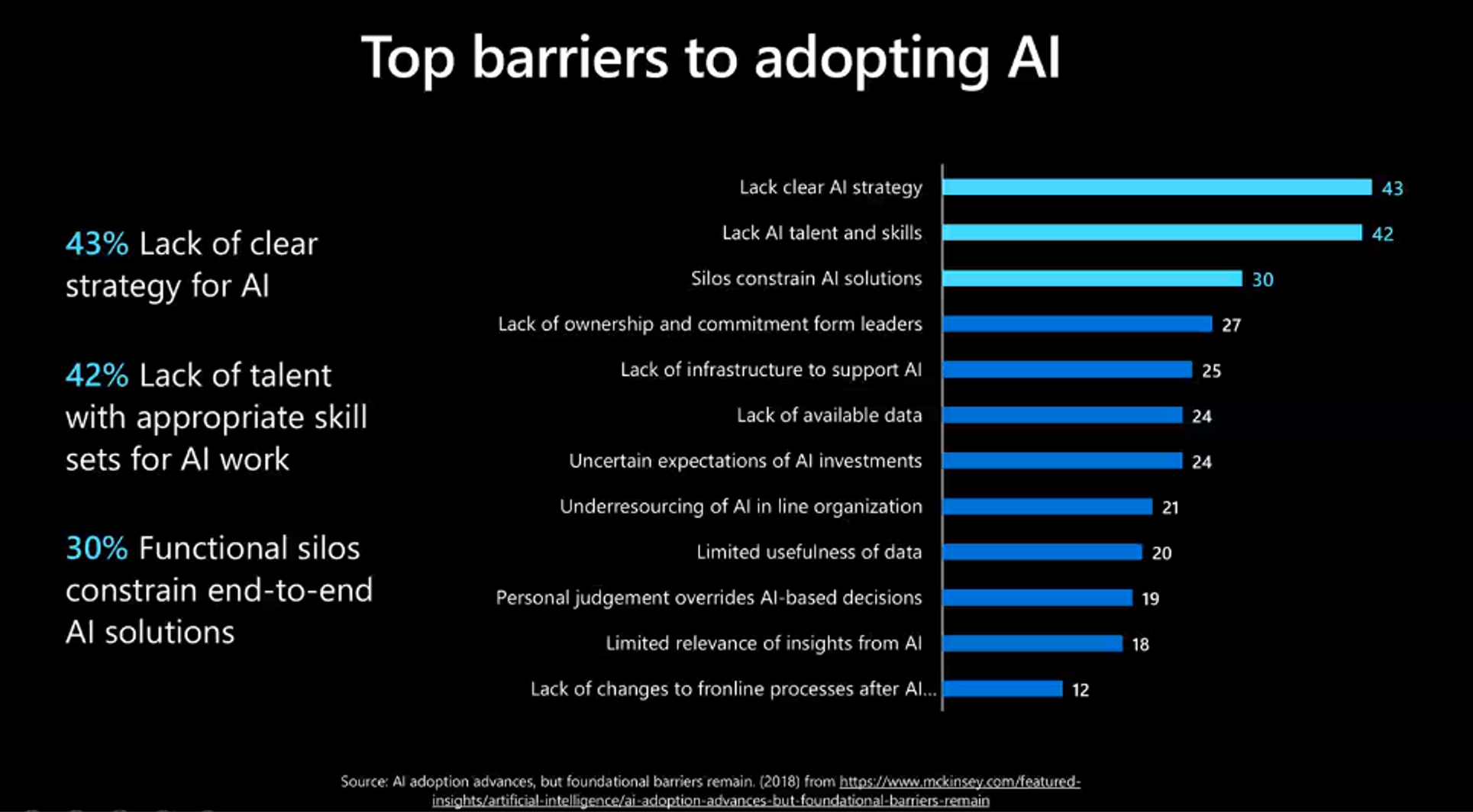

Most government agencies wouldn’t know how to start their AI and platform modernization as this entails choosing technology, navigating the market for vendors and system to working with trusted partners. AI adoption for government services must always be ethical.

Get in touch with AI Consulting Group via email, on the phone, or in person.

Send us an email with the details of your enquiry including any attachments and we’ll contact you within 24 hours.

Call us if you have an immediate requirement and you’d like to chat to someone about your project needs or strategy.

We would be delighted to meet for a coffee, beer or a meal and discuss your requirements with you and your team.